Credit Score Trends in 2024

As we navigate through 2024, Experian Credit USA has conducted a comprehensive analysis of credit score trends across the United States. Our findings reveal intriguing regional differences and key factors influencing scores.

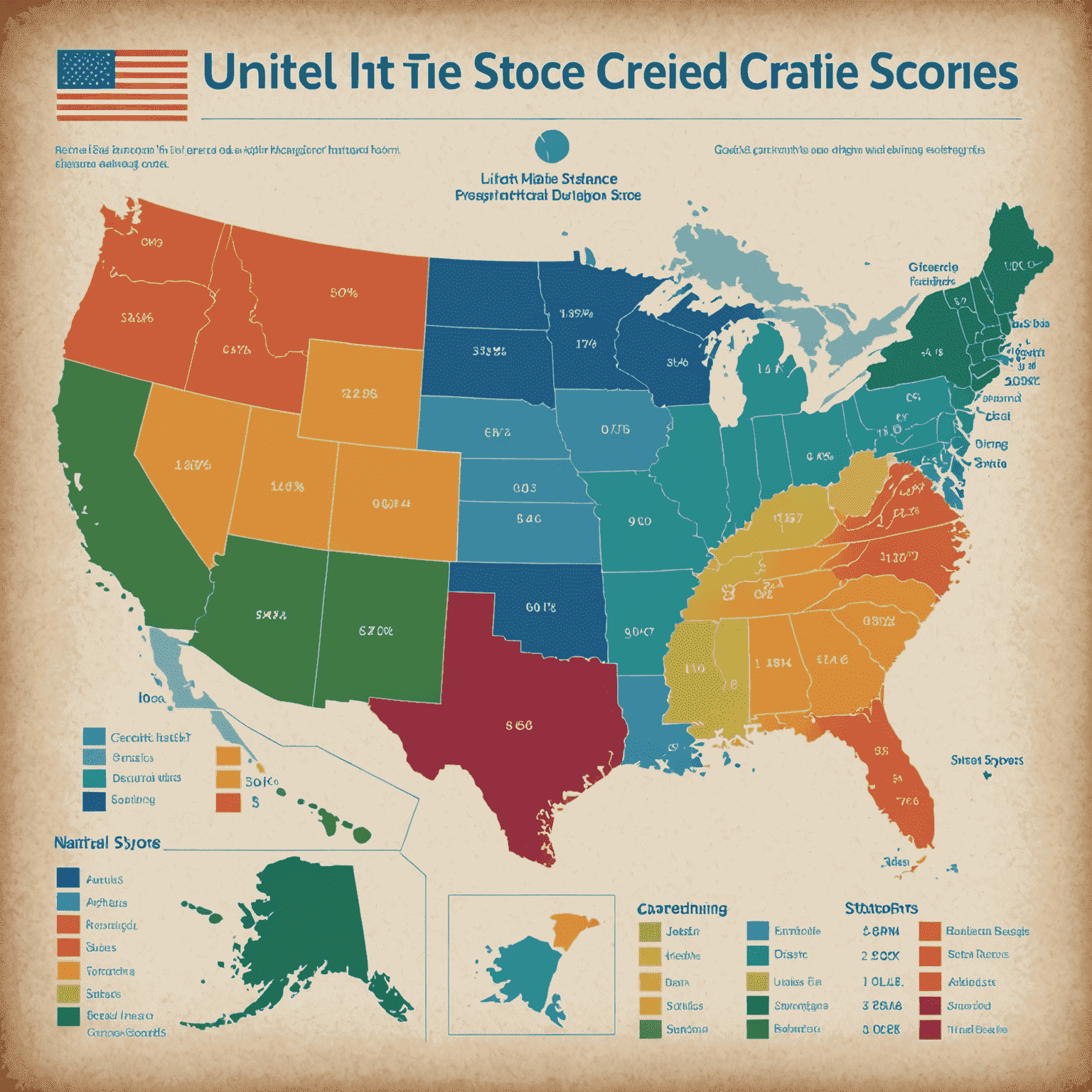

Regional Variations

Our analysis shows significant regional disparities in credit scores across the country:

- Northeast: Consistently high scores, with an average of 720

- Midwest: Solid performance, averaging 710

- West Coast: Mixed results, ranging from 690 to 730

- Southeast: Room for improvement, with an average of 680

- Southwest: Showing progress, with scores averaging 695

Influencing Factors

Several key factors have emerged as significant influences on credit scores in 2024:

- Economic Recovery: Post-pandemic economic rebound has positively impacted scores in many regions.

- Remote Work Shift: Changes in employment patterns have affected income stability and credit utilization.

- Financial Education: Increased access to credit information and financial literacy programs has empowered consumers.

- Digital Banking Adoption: Easier access to financial tools has improved credit management for many.

- Policy Changes: New credit reporting regulations have influenced how scores are calculated and reported.

Expert Insight

"The 2024 credit landscape reflects a nation in transition. While we see encouraging trends in some areas, there's still work to be done in others. At Experian, we're committed to providing the tools and knowledge to help every American achieve their best possible credit score."

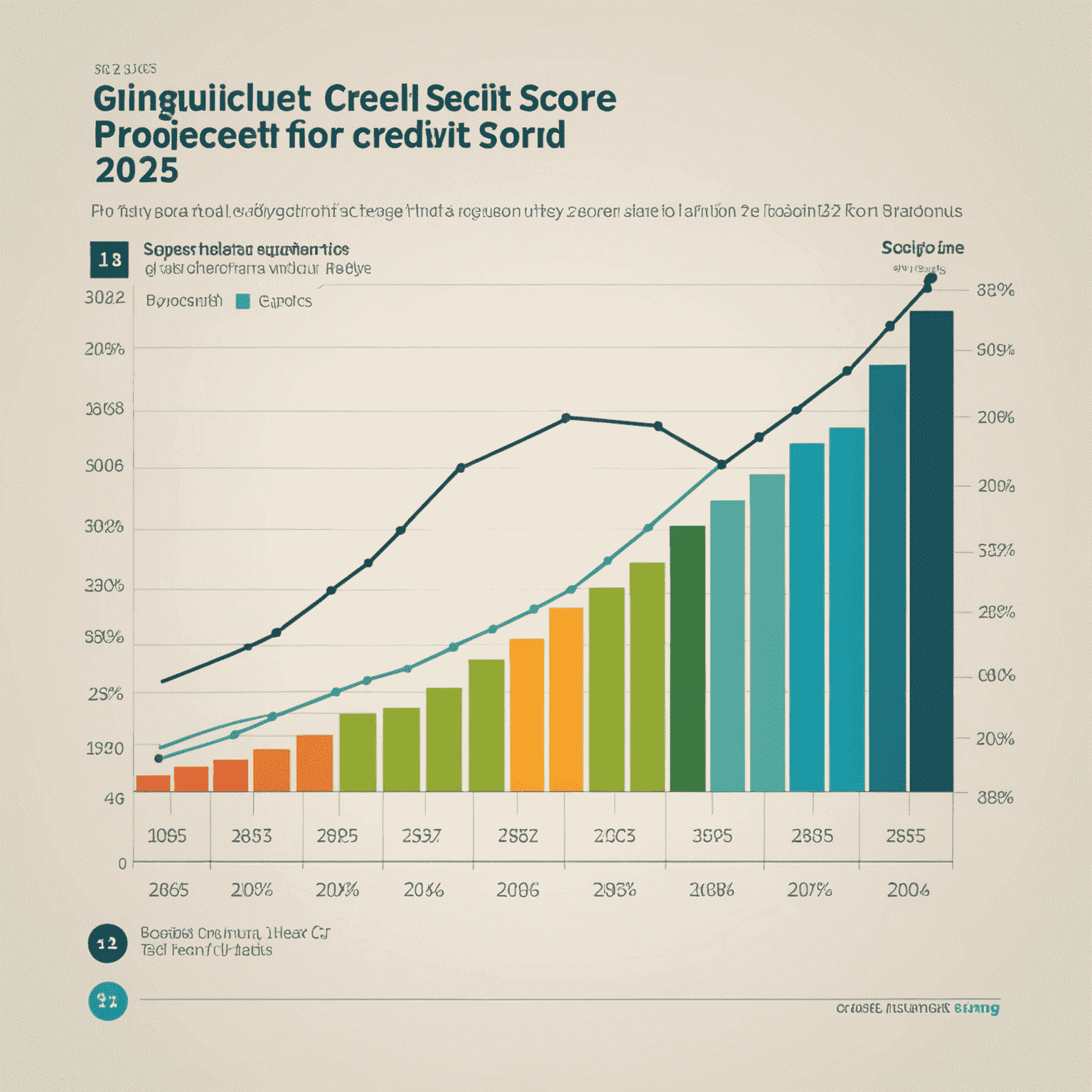

Looking Ahead

As we move through 2024 and beyond, Experian Credit USA anticipates continued evolution in credit score trends. We remain dedicated to empowering consumers with the insights and tools needed to navigate their financial futures with confidence.

Stay tuned to Experian Credit USA for more updates and in-depth analyses of credit trends that matter to you. Remember, understanding these trends is just the first step – take action today to improve your credit score and financial well-being.