Credit Score Access

Get instant access to your FICO® Score and Experian credit report. Understand the factors affecting your credit and track changes over time.

Why Check Your Credit Score?

- Gain insights into your financial health

- Identify areas for credit improvement

- Detect potential identity theft early

- Prepare for major financial decisions

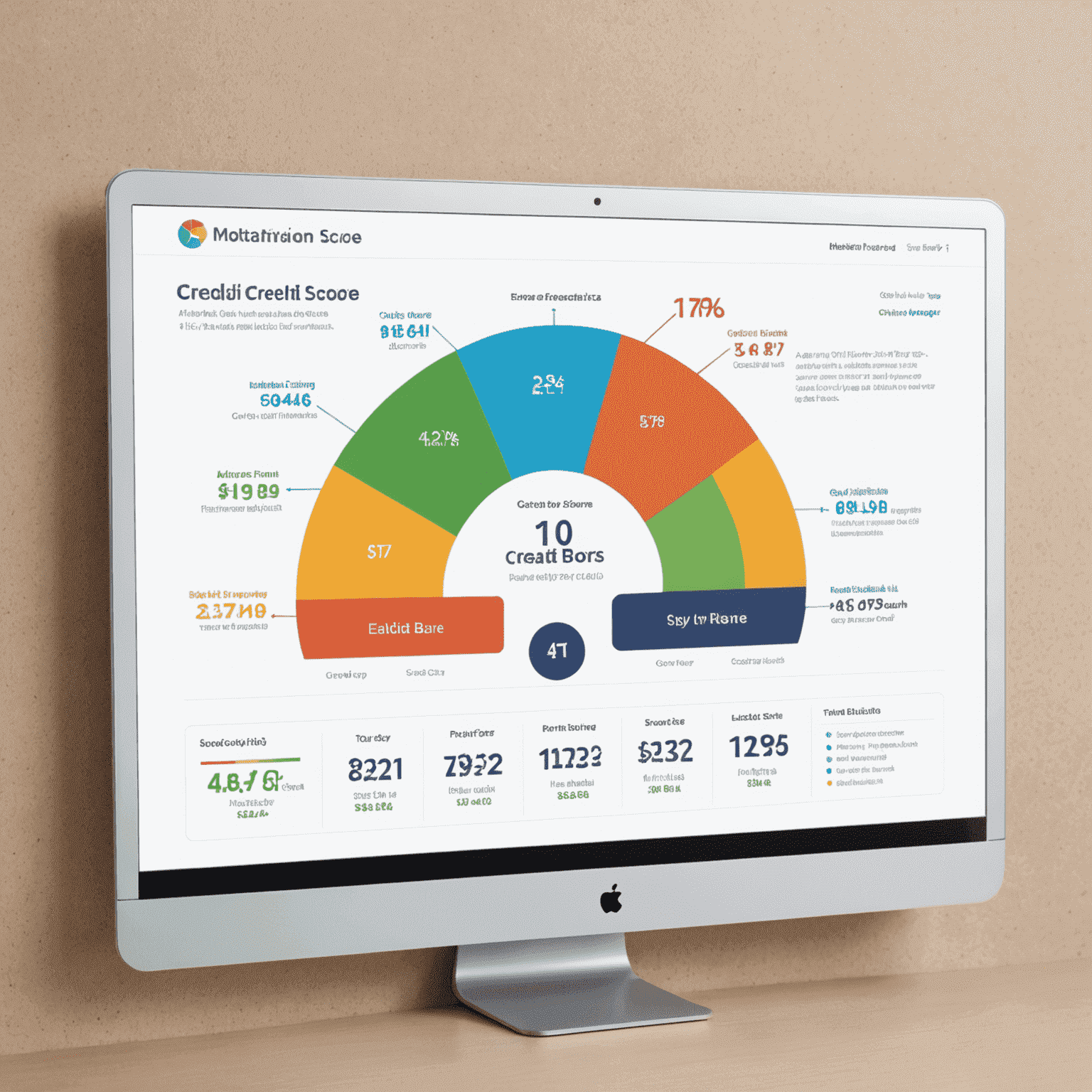

Your Credit Journey Visualized

Understanding Your FICO® Score

Your FICO® Score is a three-digit number based on the information in your Experian credit report. It's one of the most widely used credit scores by lenders to assess your creditworthiness. Here's what influences your score:

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit (10%)

Experian Advantage

With Experian Credit USA, you're not just getting a number. Our comprehensive tools and expert insights help you:

- Track score changes month-to-month

- Receive alerts on important changes to your credit report

- Get personalized tips to improve your credit score

- Simulate how financial decisions might impact your score

Your Financial Future Starts Here

Whether you're planning to buy a home, finance a car, or simply want to maintain good credit health, understanding your credit score is the first step. With Experian Credit USA, you have the tools and knowledge to take control of your financial future.